For Bankers

Empower Your Leadership: Drive Your FI's Future with Sidecore®

FIs that want to innovate often feel stifled because new ideas aren’t compatible with their legacy cores. It shouldn’t be that way, and with Sidecore it isn’t.

Sidecore is NOT a replacement for an FI’s legacy core and the existing business that is tied to that legacy core. System61 does not endeavor to change that existing business. That’s a larger issue for another day. Instead, we offer FIs an opportunity to continue to run their existing business on their legacy core while building a future that is not bound by it.

Unleash your team’s ability to create new and unique mobile and web products that will truly set your FI apart from the pack.

Our app development team is here to help you get your first product launched. From ideation to prototyping to coding and all the way up to launch, our seasoned team can help get you started while you build out these competencies within your FI.

Discover What Sets Us Apart

-

Published APIs

Our published APIs allow you to create, maintain and modify digital products as and when you prefer.

-

Data Warehouse

Our analytics solution can be used as either an onramp for data into any existing solution you have, or a basis from which to build such a company-wide analytics solution.

-

FI Management Dashboard

Our web app will seamlessly compile and consolidate data from your Sidecore banking apps, ensuring you have a complete and real time view of your customers’ account history.

Customer Relationship

Legacy Core Limitation

The customer relationship is tied to a single account number through which all transactions are managed, resulting in minimal control over budgeting and overall financial management.

Sidecore Innovation

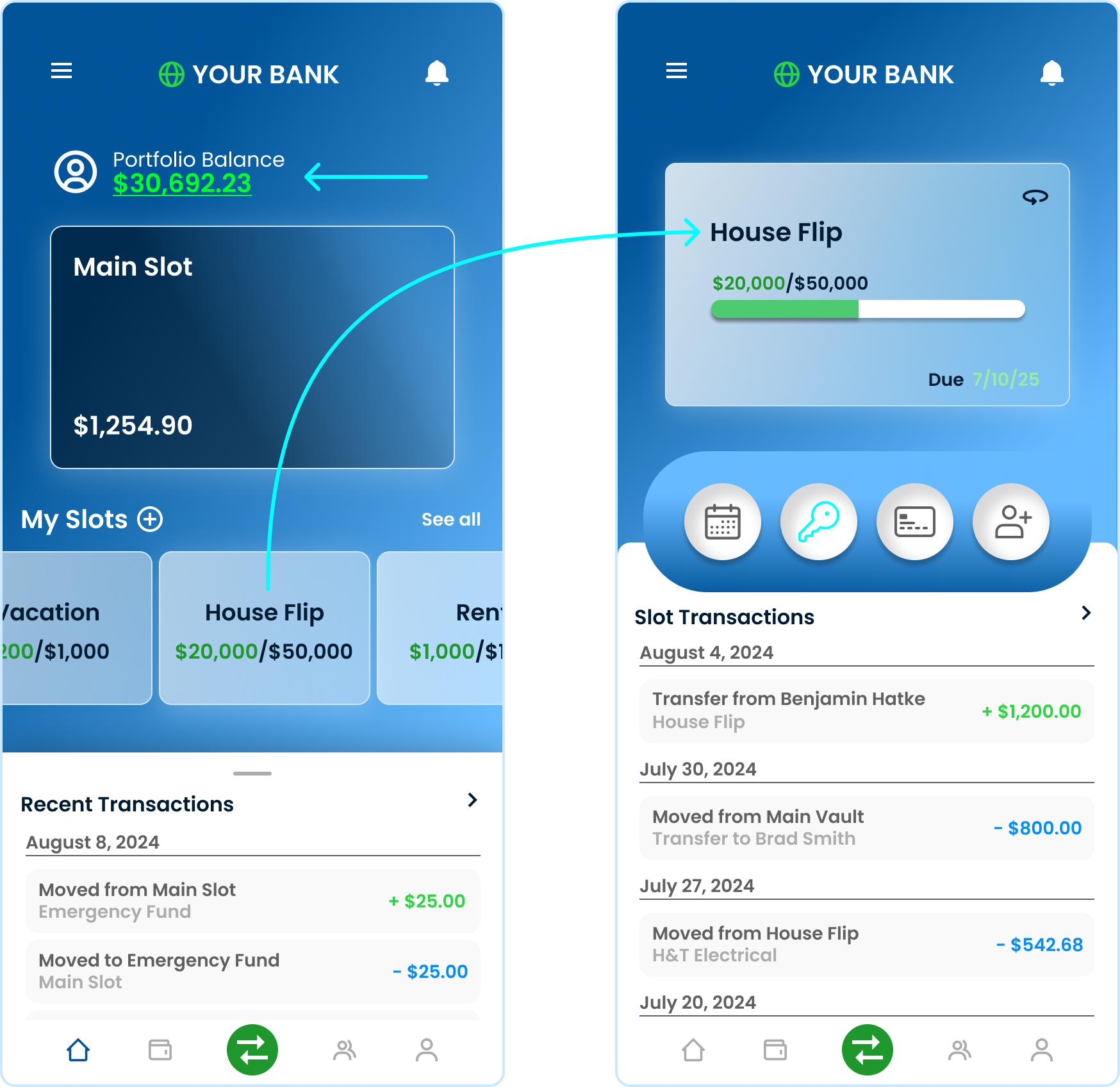

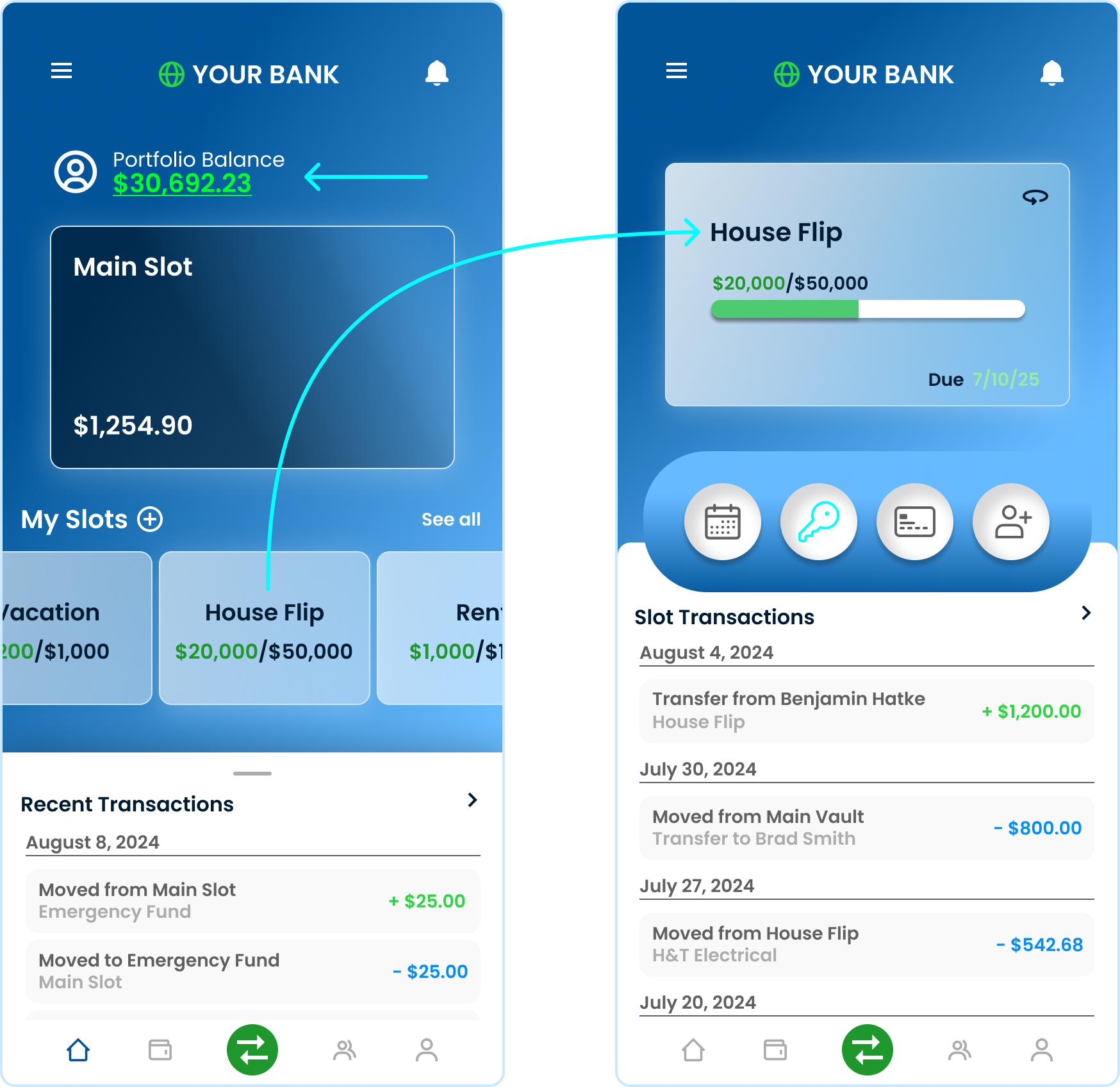

With Sidecore the customer relationship is tied to a “Portfolio” which puts the customer in control. A customer can also create multiple “Slots” within the Portfolio. Slots allow Customers to separate the money inside their Portfolio into groups, giving them the ability to define exactly how the money will be used.

The image on the right illustrates how a customer can use a Slot to manage their housing investment within an app.

- Slots can help a customer organize savings, expenses and even loans

- Each Slot generates its own unique “account” number (we call them Keys) that the customer may use to make or accept payments with third parties

Payments

Legacy Core Limitation

The customer relies on a single account number for all payment transactions, which limits their ability to budget effectively or manage different categories of expenses and income separately.

Additionally, using the same account number for all transactions means that third parties gain access to the account holding the customer’s entire balance.

Sidecore Innovation

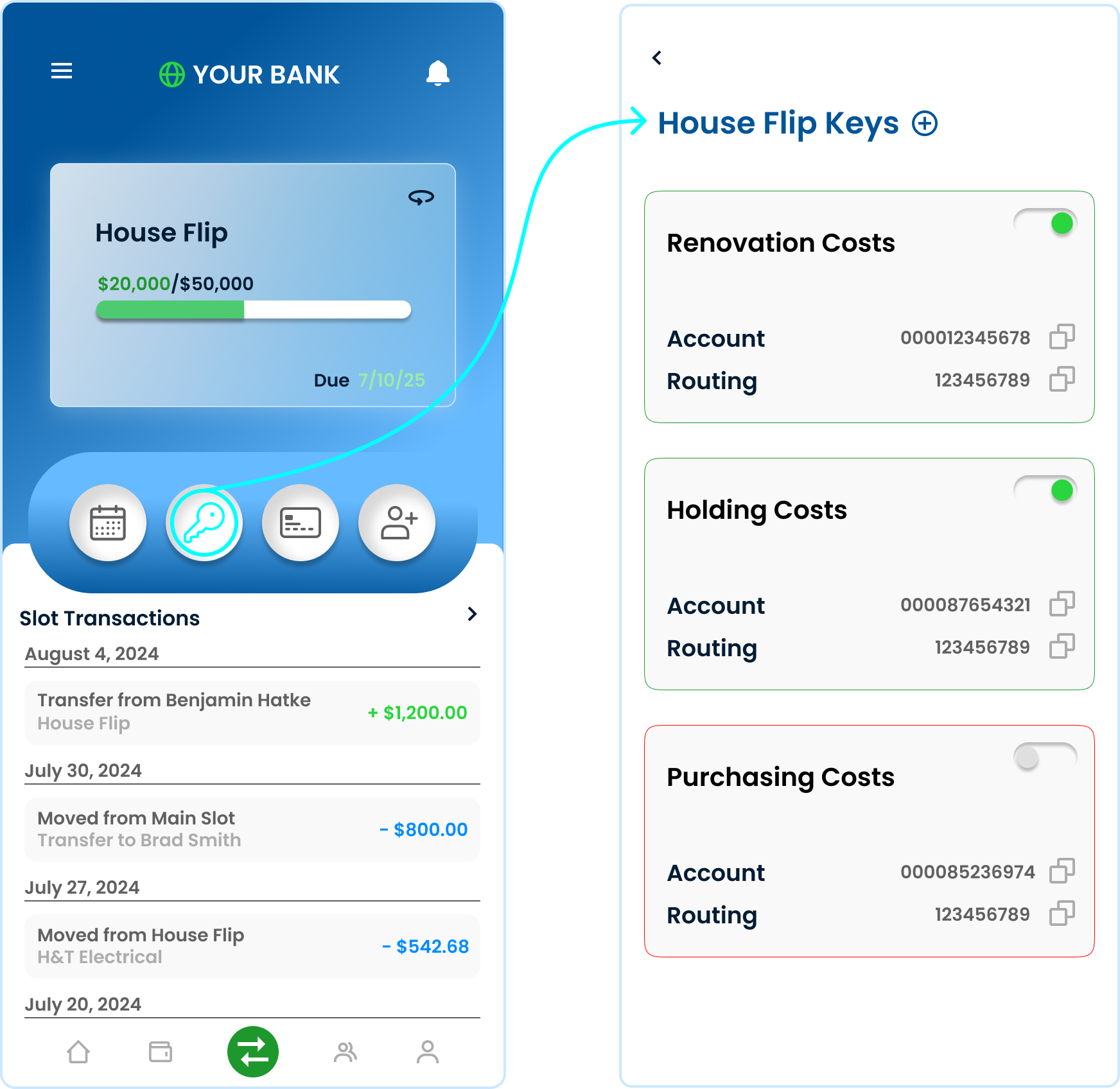

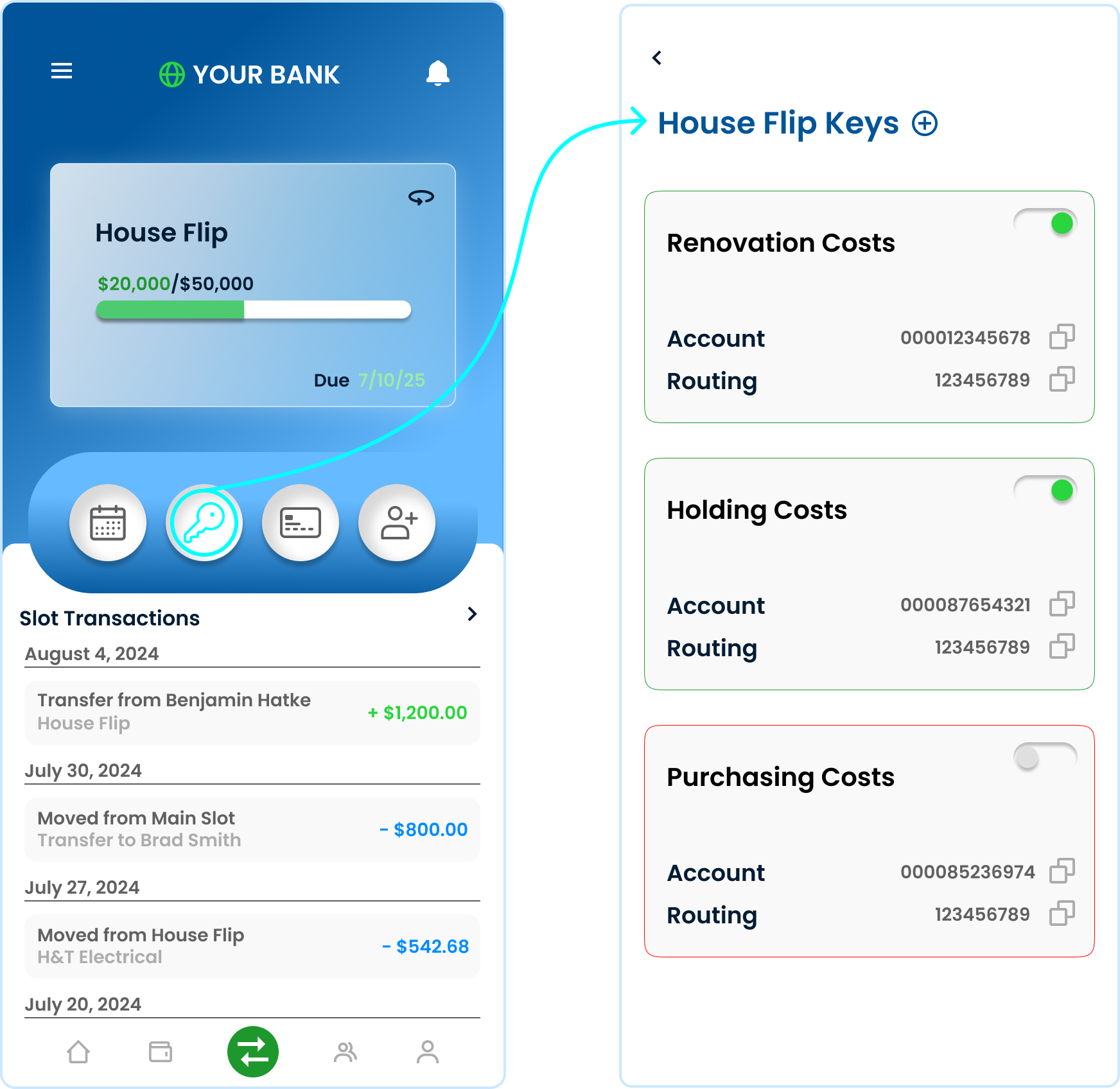

A customer can create a unique Key for each Slot and transact business with various third parties via different Slots.

- Slots Keys may be turned on or off at customer’s discretion

- Slots can be shared with third parties, with permissions managed by the customer. For example, the customer can authorize certain third parties to both deposit and withdraw from a specific Slot, while granting others permission to only make deposits

- A customer can also create and cancel debit cards tied to particular Slots

Transaction Processing

Legacy Core Limitation

All transactions are processed simultaneously through batch processing only once per day – no holidays or weekends!

Sidecore Innovation

Transactions happen 24x7x365 in real time and are logged on the transaction blockchain.

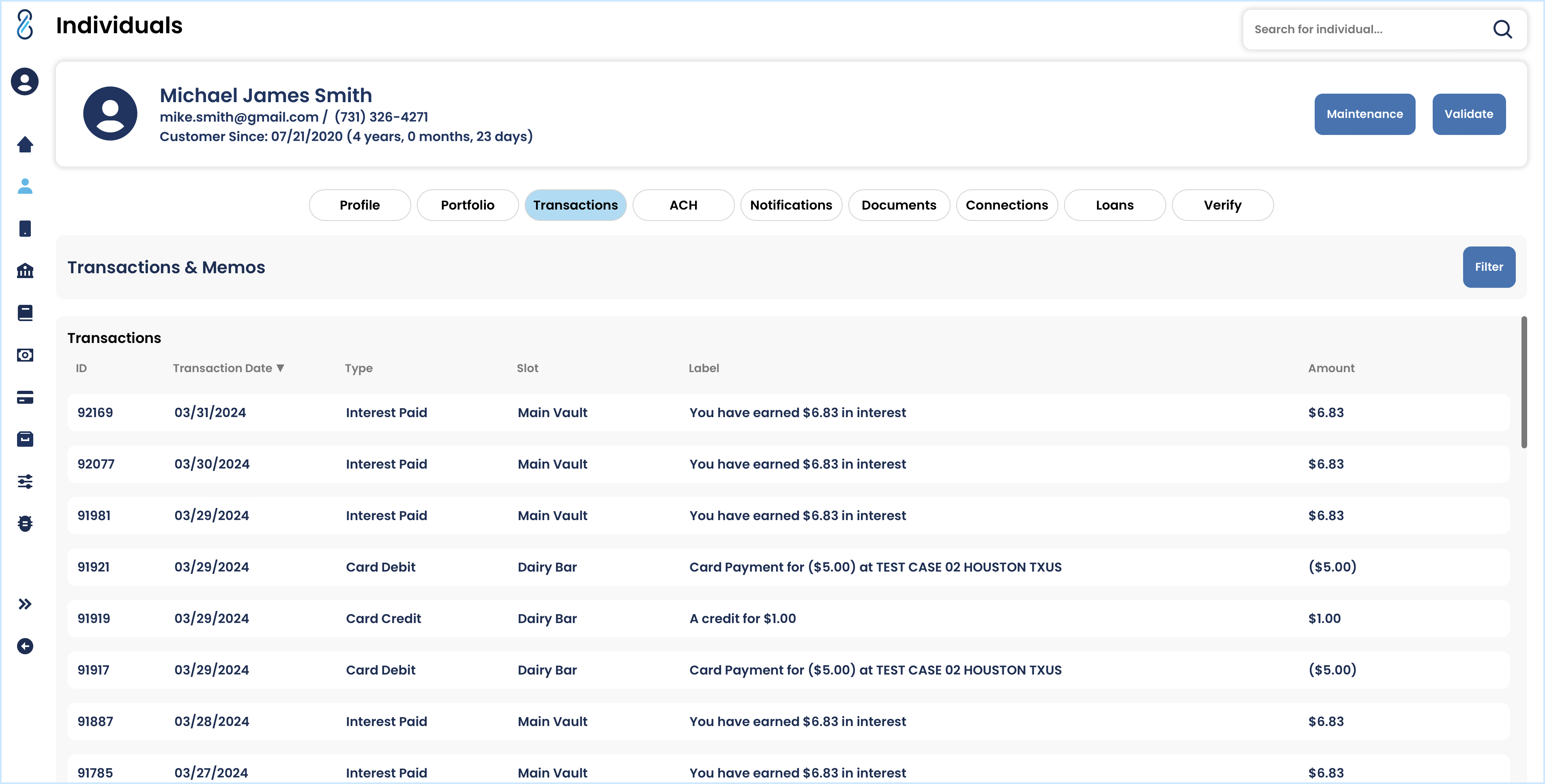

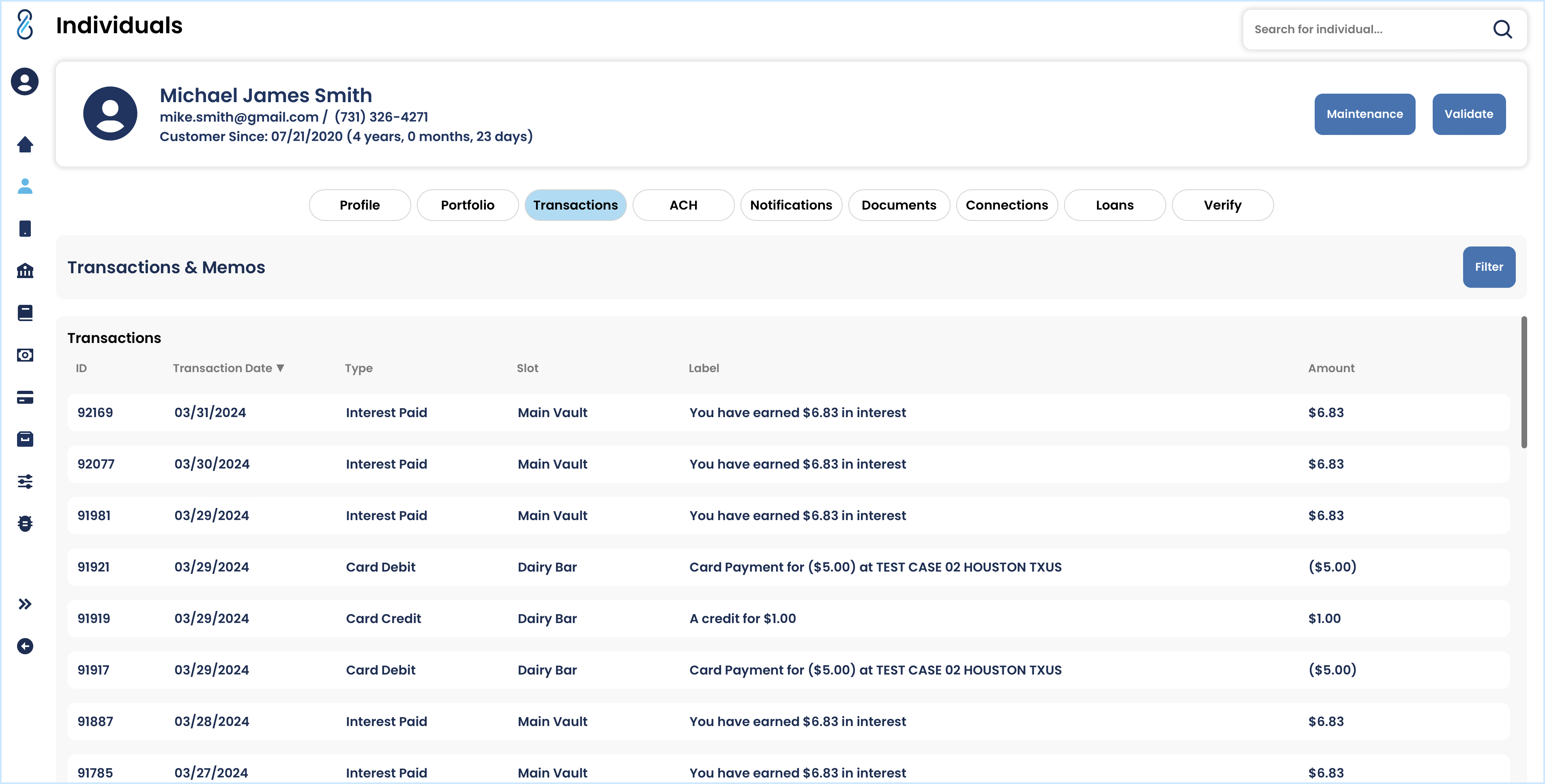

S61 also provides an FI management dashboard, designed to equip you with the essential tools to evaluate transaction processing and more, all from a single, centralized platform. The image on the right showcases the transactions section of our dashboard.

- Prevents significant administrative overhead when batch process runs incorrectly

- Gain detailed transaction insight from the S61 FI management dashboard